To make student loans more affordable, income-driven repayment plans base monthly payments on a borrower’s income and family size, and extend repayment periods. Borrowers in these plans are also eligible for forgiveness after 20 or 25 years of qualifying payments.

But the Department of Education has had trouble tracking borrowers’ payments and hasn’t done enough to ensure that all eligible borrowers receive the forgiveness to which they are entitled. We found thousands of borrowers still in repayment who could be eligible for forgiveness now.

What GAO Found

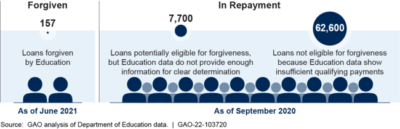

The Department of Education approved forgiveness for a total of 157 loans under Income-Driven Repayment (IDR) plans as of June 1, 2021, but has not taken the steps necessary to ensure that all eligible loans receive IDR forgiveness. IDR plans generally lower monthly payment amounts and extend repayment to 20 or 25 years of qualifying payments, after which borrowers become eligible for forgiveness of their remaining loan balances without needing to apply. However, GAO found that about 7,700 loans in repayment (about 11 percent of loans analyzed) could be potentially eligible for IDR forgiveness. Education’s repayment data do not provide enough information to definitively determine why these loans—totaling about $49 million in outstanding debt—had not been forgiven as of September 1, 2020 (see figure). Education officials said data limitations make it difficult to track some qualifying payments and older loans are at higher risk for payment tracking errors. Until Education takes steps to address such errors, some borrowers may not receive the IDR forgiveness they are entitled. This risk will increase as Education data show loans potentially eligible for IDR forgiveness will climb to about 1.5 million loans by 2030.

Selected Outcomes for Loans in Repayment Long Enough to be Potentially Eligible for Income-Driven Repayment Forgiveness

GAO identified gaps in the information Education and its loan servicers provide to borrowers about IDR forgiveness.

- Education does not provide information about the requirements for receiving IDR forgiveness, including what counts as a qualifying payment toward forgiveness, in key communications to IDR borrowers. Borrowers who do not receive this information may be unaware that months in forbearance and most types of deferment generally do not count. Additional information would help borrowers understand requirements for forgiveness.

- Education and its servicers told GAO they do not provide regular updates to borrowers in IDR plans on the counts of qualifying payments made toward forgiveness unless borrowers request them. They also do not notify all borrowers about options to request and verify these counts. Providing this information is especially important given the risk of payment tracking errors.

Unless Education ensures borrowers are better informed about forgiveness requirements and qualifying payment counts, IDR borrowers may make uninformed decisions and be unable to correct inaccurate counts, potentially delaying forgiveness.

Why GAO Did This Study

About half of the more than $1 trillion in outstanding federal student Direct Loans are being repaid by borrowers using IDR plans. Some borrowers in IDR plans are now potentially eligible for forgiveness of their remaining loan balances after 20 or 25 years of payments. GAO was asked to review IDR forgiveness.

This report examines (1) how many loans have received IDR forgiveness and the extent to which Education ensures eligible loans receive forgiveness, and (2) the extent to which Education provides key information about IDR forgiveness to borrowers in IDR plans.

GAO analyzed Education data on IDR loans that had been in repayment long enough to be potentially eligible for IDR forgiveness as of September 1, 2020, and data on loans forgiven as of June 1, 2021, the most recent data available. In addition, GAO interviewed Education and loan servicer officials, and reviewed documents from all nine servicers operating in 2020, Education requirements, and relevant federal laws and regulations.

Read the whole report here:

719612