Click here to download a PDF copy of the report.

This paper is intended to serve as a primer on recent Public Laws and legislation intended to mitigate the economic impact of the coronavirus emergency on students attending and the institutions providing postsecondary education. We also assess what these laws mean for GI Bill beneficiaries and other VA-supported students.

P.L. 116-136, the Coronavirus Aid, Relief, and Economic Security Act (CARES), was signed into law on March 27, 2020. Seventeen sections of this over 300-page bill makes temporary exemptions to requirements of the Higher Education Act (HEA) and other legislation such as the Workforce Innovation Opportunity Act (WIOA).[1]

P.L. 116-128, which became law on March 21, 2020, ensures VA-funded students don’t suffer any change to their tuition benefits or housing allowance if their school converts to online learning because of the coronavirus or other national emergencies.

P.L. 116-140, the Student Veteran Coronavirus Response Act, was signed into law on April 28, 2020. Among other provisions, this law keeps student veterans’ work-study paychecks flowing during the coronavirus emergency; continues benefits payments during all emergencies, not just coronavirus; and extends school closure protections to student veterans receiving vocational rehabilitation benefits.

CARES Act Highlights

In general, the CARES Act provides exemptions to statutory requirements to help mitigate the impact of the coronavirus emergency on postsecondary students and schools. These exemptions are temporary, expiring at the end of the coronavirus emergency; within a year after its end, on September 30, 2020 (§ 3513, § 3517); or, upon completion of award year 2020-21 (§ 3503). The authorities of one provision (§ 3510) are available only to institutions that switched from classroom to online instruction between March 1 and the date of enactment of the CARES Act.

Excluding “definitions” (§ 3502), the CARES Act has 17 postsecondary-related provisions. The summary below groups together related sections of the CARES Act.

Grants to Students

- Gives institutions flexibility in providing emergency grants of $100 to $4,000 to students for unexpected expenses and unmet financial needs (§ 3504).

- Requires that 50 percent of the higher education emergency relief funds (totaling about $14.25 billion) be used for emergency financial grants to students for coronavirus-related expenses (§ 18004).

Other Student Relief

Pell Grants

- Allows exclusion of Pell Grants awards from the lifetime cap on such grants during a semester not completed because of the coronavirus (§ 3507).

- Individuals serving in AmeriCorps, Learn and Serve America, and Senior Corps will still accrue hours that count toward an education award if their community service is affected by the coronavirus emergency. Education awards are equal to the maximum Pell Grant award and may also be used to repay qualified student loans (§ 3514).

Teach Grants

- Individuals who received grants for pursuing teaching careers in high-need subjects in high-poverty areas whose teaching commitment is interrupted because of the coronavirus emergency have will have that interrupted service counted in order to avoid having the grants converted into federal loans (§ 3519).

Student Loan Relief

- Suspends student loan repayments for federal Direct Loan and loans issued under the former Federal Family Education Loan Program (FFELP) and held by ED. During the suspension, no interest will accrue; involuntary collections on defaulted loans (wage garnishment) will cease; and credit will be granted toward loan forgiveness or loan rehabilitation. FFELP loans not held by ED, federal Perkins Loans, and private student loans are not covered by this suspension (§ 3515).

Satisfactory Academic Progress

- Courses not completed due to the coronavirus emergency can be excluded from determinations of whether students maintain satisfactory academic progress, a requirement for continuing to receive federal student aid (§ 3509).

Minority Serving Institutions[2]

- Defers principal and interest payments on capital financing loans to historically black colleges and universities (HCBU) (§ 3512).

- Makes technical amendments to provisions of the Internal Revenue Service (IRS) code on the confidentially of income tax returns used in granting federal student aid. These IRS code provisions were amended when mandatory funding for HCBUs was reauthorized in 2019 (§ 3516).

- Allows ED to waive certain requirements for minority and Hispanic serving institutions and for master’s degree programs at HCBUs receiving grants though the federal fiscal year following the end of the coronavirus emergency (§ 3517).

- 5 percent of emergency relief funds must be allocated to HCBUs and minority serving institutions and 2.5 percent to institutions with the greatest unmet needs (§ 18004).

Work Study

- Requires ED to waive the 25 percent institutional share of federal work study grants or needs based grants to undergraduates with exceptional needs for award years 2019-20 and 2020-21 (§3503).

- Institutions may continue making payments to students who were unable to complete some of all of their work study obligations due to the coronavirus emergency for a period not exceeding 1 academic year (§ 3505).[3]

Refunds of Title IV

- Waives institutional and borrower responsibility to refund federal student aid to ED if a borrower withdraws before completing 60 percent of a term due to the coronavirus emergency (§ 3508).

Workforce Development Programs

- Provides flexibility for state and local authorities who receive federal grants for administering workforce development programs if the flexibility is used to respond to the coronavirus emergency (§ 3515).

Emergency Relief Fund for Institutions Switching to Online Modalities

- Allows Title IV-eligible programs at foreign institutions to be offered via distance education for the duration of the coronavirus emergency (§ 3510).

- Ninety percent of the $14.25 billion in emergency relief funds are for addressing issues related to students not exclusively enrolled in distance education prior to the emergency. Allows the use of 50 percent of emergency allocations for costs associated with converting classroom instruction to online modalities. Prohibits payments to contractors for pre-enrollment activities; endowments; or capital outlays for sectarian instruction, religious worship, or athletics (§18004).

Appendix I contains a detailed summary of the CARES Act higher education provisions as well as P.L. 116-128, which gave VA the authority to temporarily disregard statutory requirements related to online education, and HR 6322, which would address VA students’ work study funds.

P.L. 116-128 Highlights

P.L. 116-128 ensures that GI Bill and other VA-supported students whose classes have been transitioned to online modalities will not see a decrease in their housing benefits or have their programs disapproved. VA had determined under the GI Bill statute the conversion of classes to online would have required it to reduce students’ housing allowance by half and possibly defund entire programs that had not been previously approved to offer online education.

P.L. 116-140 Highlights

P.L. 116-140, the Student Veteran Coronavirus Response Act, passed the House and Senate on March 31 and April 21, respectively, and was signed into law on April 28, 2020. Among other provisions, the law provides parity to VA-supported students (to match the rights already accorded to Title IV ED-supported students under the CARES Act) by keeping VA-supported work-study paychecks flowing during the coronavirus emergency; continuing benefits payments during all emergencies, not just coronavirus; and extending school closure protections to student veterans receiving vocational rehabilitation benefits.

Relevance of Coronavirus-Related Legislation to GI Bill Beneficiaries

The higher education provisions of the CARES Act and P.L. 116-128 will benefit the majority of the approximately 900,000 GI Bill beneficiaries using their educational benefits by providing funding to help the institutions they attend convert to online modalities, reserving half of the emergency funding for grants to help students effected by the coronavirus emergency, and ensuring that the educational benefits of veterans and eligible family members are not interrupted by statutory requirements related to online instruction. H.R. 6322, if passed by the Senate, will expand the protections available to GI Bill and other VA-supported students during the coronavirus and similar emergencies such as continuing work-study paychecks and by extending vocational rehabilitation benefits when schools close.

How Will Higher Education Relief Funds Be Allocated Across Institutional Sectors?

Higher education emergency relief funds authorized by § 18004 of P.L. 116-136, the Coronavirus Aid, Relief, and Economic Security Act (CARES), are limited to institutions whose students were attending classes at a brick-and-mortar campus.[4] Funds are not available if students were enrolled exclusively online.

The American Council on Education (ACE) published “preliminary, best guess estimates” of how 90 percent of the higher education emergency relief funds (approximately $12.5 billion) will be allocated by state, by institutional sector within each state, and for each school participating in federal student aid.[5] The ACE estimates provide a benchmark with which to assess ED’s allocations of the emergency funds, which were published on April 9, 2020.

Institutional Sector Breakdown of CARE Act Funds

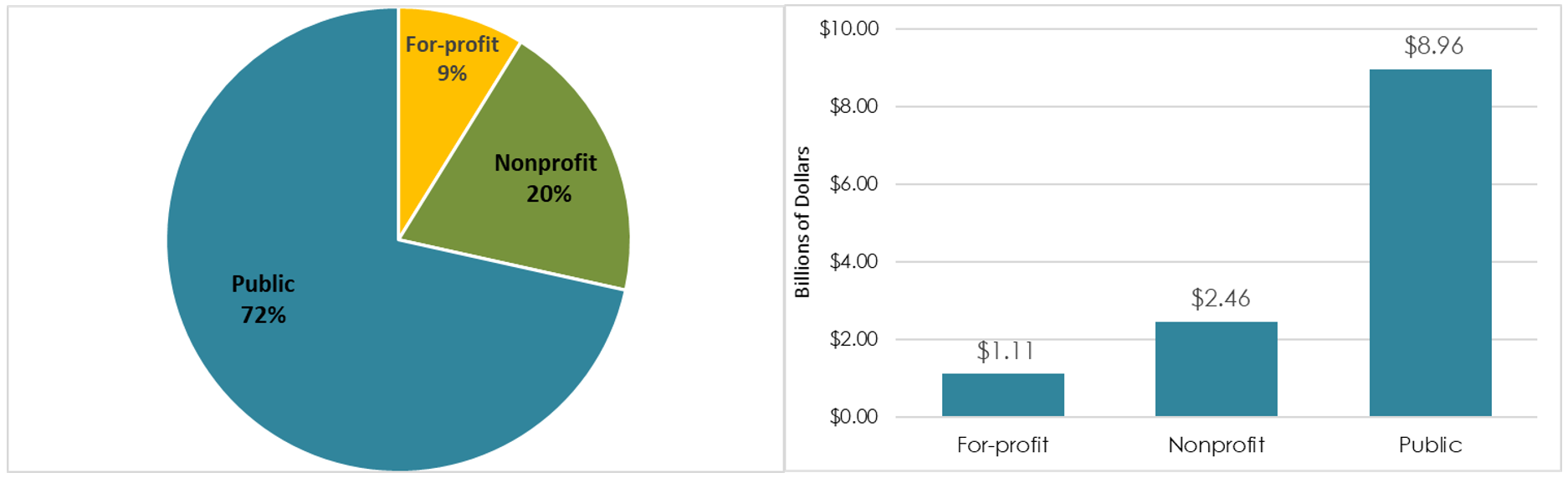

Because ACE did not publish estimates of total allocations by institutional sector—public, nonprofit, and for-profit—we conducted our own sector analysis. We found that 91 percent of the emergency funds could be allocated to public and nonprofit institutions. Only about 9 percent ($1.1 billion) may end up being distributed to for-profit schools (see figs. 1 and 2). ED’s actual allocations by sector were almost identical to our findings—71 percent ($8.93 billion) and 20 percent ($2.46 billion) to public and nonprofit institutions and 9 percent ($1.11 billion) to for-profit schools. As discussed below, there was greater variability between the ACE estimates and ED’s actual allocations to specific institutions.

Figures 1 and 2: Estimated Distribution of $12.5 Bill of CARES Act Emergency Relief Funds by Institutional Sector

Source: Veterans Education Success Analysis of ACE simulation.

Note: The methodology used by ACE to develop these estimate can be found here.

Although many public and nonprofit institutions now offer online programs, most offer primarily campus-based classes to students. Students in exclusively online programs at these public and nonprofit institutions would not be counted in determining the allocation of CARES Act emergency relief funds. For example, all or the vast majority of students at nonprofit Western Governor’s University (100 percent), University of Southern New Hampshire (93 percent), and Liberty University (81 percent) are enrolled exclusively online and would not be counted in determining allocation of CARES Act emergency relief funds. At Arizona State University, which has a strong online presence, only 34 percent of its students are exclusively online. Public institutions with a high percentage of exclusively online students who would not be counted in determining allocation of CARES Act emergency relief funds include University of Maryland Global Campus (80 percent) and Colorado State University Global Campus (100 percent).

CARE Act Funds Allocated to Three Chains Under Law Enforcement Action

We also used the ACE estimates to calculate the proportion of the emergency funds that could potentially be allocated to all of the campuses operated by three large for-profit chains that are primarily or exclusively online—Bridgepoint Education, Apollo Global Management, and Career Education Corporation.[6] These chain-owned schools operate under the following brand names: Ashford University, University of Phoenix, Colorado Technical University, and American InterContinental University.[7] The schools’ owners could receive $9.4 million in relief funds, about .075 percent of the $12.5 billion to be allocated (see table 1). As shown in table 1, the actual allocations published by ED differed for three of the four schools but the total allocation for all four schools is similar. The differences between the ACE estimate and the actual allocations may be that ED adjusted some of the data for 2017-18 enrollments using data reported for 2018-19 or fall 2018 while the ACE methodology made no such adjustments.

Table 1: CARES Act Estimated Emergency Relief Funding and Actual Allocation for Four Primarily or Exclusively Online For-Profit Schools

| For-profit school | Percentage enrolled exclusively onlinea | Number of locations | Estimated allocation | Education Department allocationb |

| Ashford | 100% | 1 | $1,000 | $1,001 |

| University of Phoenix | 99% | 19 | $7,534,000 | $6,589,433 |

| Colorado Technical University | 96% | 3 | $631,000 | $1,581,179 |

| American InterContinental University | 95% | 1 | $1,216,000 | $1,150,405 |

| Total | $9,382,000 | $9,322,018 |

Source: Veterans Education Success Analysis of ACE simulation and actual allocations published by the Education Department.

aPercentage enrolled exclusively online is data reported by institutions for the fall of 2017.

bThe Department of Education’s allocations of emergency relief funds under § 18004(a)(1) of the CARES Act were published on April 9, 2020. The Department reiterated the stipulation in § 18004 that half of each amount was reserved for emergency financial aid grants to students. In describing its allocation methodology, it stated that it was reserving $50 million to be provided in a subsequent award because “limitations of available data preclude calculating precise amounts.”

On March 9, 2020, VA announced that it intended to cut off the new enrollment of GI Bill beneficiaries at the University of Phoenix, Colorado Technical University, and American InterContinental University for violating Title 38 § 3696 unless the schools implemented corrective actions within 60 days.[8] Title 38 § 3696 prohibits VA from approving enrollment of GI Bill beneficiaries at schools that use erroneous, deceptive, or misleading recruitment practices. The owners of these schools had settled lawsuits with the Federal Trade Commission (FTC) in 2019 which provided the evidence VA used to justify its actions. Phoenix paid a $191 million fine and Career Education Corporation, the owners of the other two schools, paid a $30 million fine and agreed to erase nearly $500 million in student loan debt in a separate settlement with 49 state Attorney’s General. Similarly, a still-pending November 2017 lawsuit by the California Attorney General provides strong evidence that Ashford has also used similar deceptive practices to recruit veterans. On April 9, 2020, 33 military and veteran service organizations, sent a letter to VA, expressing support for its actions enforcing 38 U.S.C. § 3696.

Other Areas of Concern

Several additional CARES Act and GI Bill areas of concern include:

- Failure to include suspension of debt collections by VA. GI Bill students may receive benefit payments, referred to as overpayments. For GI Bill students, the overpayments are often the result of benefits being paid (1) at the beginning of a school term based on classes that were subsequently dropped or (2) before withdrawal from school altogether. VA can withhold future benefit payments or offset tax returns to collect the overpayments. Several bills have been introduced to suspend VA debt collections. In mid-April 2020, the VA Debt Management Center announced it was (1) suspending all actions on veteran debts under the jurisdiction of the Treasury Department; and (2) “[s]uspending collection action or extending repayment terms on preexisting VA debts, as the Veteran prefers.” Both of these relief actions are in place “until further notice.” This decision does not address VA’s ability to withhold future benefit payments.

- The omission of private student loans and FFELP loans not owned by ED from the temporary suspension of student loan payments. A draft report by Veterans Education Success found that a significant proportion of veterans had taken out private student loans since 2007-08 even though the proportion of veterans with such loans had declined sharply by 2015-16.

- 3506 and § 3507 contain a significant loophole. They condition the relief on subsidized loan limits and the lifetime cap on Pell Grants on ED’s ability “to administer the policy in a way to limit the burden and complexity on the student.” The impact of these caveats is unclear.

- ED’s decision to count emergency relief funds allocated to schools as non-Title IV funds, undercutting enforcement of the 90 percent cap on for-profit school’s revenue from federal student aid. § 18004 mandates that half of the emergency relief funds provided to schools must be used to provide emergency financial aid grants to students, undermining ED’s decision to count those relief funds as non-Title IV. The effectiveness of the so called 90/10 rule is already undermined by the exclusion of VA and Defense Department benefits from compliance calculations even though they are also federal revenue.

- If the coronavirus leads to school closures, GI Bill beneficiary protections should be in place to discharge their federal student loans and restore the benefits they used before the schools shut down.

- The coronavirus emergency should not be used as an excuse to waive school financial responsibility standards.

- VA should step up its enforcement of § 3696 because predatory schools may increase their aggressive and deceptive targeting of veterans and servicemembers during the coming recession, as the schools did during the 2008 recession.[9]

APPENDIX I

P.L. 116-128, VA Treatment of Classes Converted to Online Instruction

On March 21, 2020, the President signed P.L. 116-128, which authorizes the VA Secretary to treat certain programs of education that converted to online learning because of the coronavirus in the same manner as programs pursued in a campus setting. The Secretary’s authority under P.L. 116-128 expires on December 21, 2020.

The coronavirus caused many colleges to shift their instruction to online classes in order to prevent the risk of infections among students attending brick-and-mortar classes. VA determined that it would be required under the GI Bill statute to reduce students’ housing allowance by half and possibly defund entire programs that had not been previously approved to offer online education. Because many GI Bill students are older than the traditional college student and are supporting families in non-dormitory housing, a 50 percent cut to the living stipend would have caused undue hardship to many student veterans and eligible family members.

Veterans Education Success, Student Veterans of America, and other veteran and military service organizations (1) partnered together to ensure military-connected students were adequately protected, (2) worked with Congressional Committee staff to quickly draft legislation, and (3) secured bipartisan agreement to move the legislation quickly.

P.L. 116-140: Student Veteran Coronavirus Response Act

P.L. 116-140, the Student Veteran Coronavirus Response Act, builds on the accomplishments of P.L. 116-128 to mitigate the impact of the coronavirus and other emergencies on GI Bill beneficiaries. P.L. 116-140 adds the following additional safeguards:

- VA work study allowances (§ 3). Individuals receiving VA-funded work-study payments on March 1, 2020, would continue to receive their paychecks if they are unable to perform their work obligations because of an emergency situation. Their work study agreements would be extended for subsequent school enrollment periods even if they were unable to perform their work-study activities.

- Beneficiaries at schools closed for an emergency (§4 and § 5). VA would be authorized to continue paying housing allowances to GI Bill students if their school closes or their education is suspended because of an emergency situation. Such payments would not count against the 4-week limit in Title 38 § 3680(a)(2)(A). Finally, GI Bill students at temporarily closed schools would have restored any months of benefits eligibility used during the closure.

- Extension of time limits for entitlement use (§6). Time limits with respect to using various GI Bill programs would not include any period during which a beneficiary is unable to enroll because an institution temporarily or permanently closed because of an emergency situation. For example, eligible individuals who were discharged from active duty before January 1, 2013 have 10 years and 15 years to begin using the Montgomery and the Post-9/11 GI Bills respectively. In effect, this provision would extend that window for the period of time that the beneficiary was unable to enroll. Similarly, this provision would also apply to (1) benefits transferred to the children of family members, which must be used before reaching age 26; and (2) the 12 year time limit for veterans eligible to participate in the vocational rehabilitation and training program, known by the acronym VR&E (vocational rehabilitation and education).

- Restoration of entitlement and extension of living allowances for veterans in rehabilitation programs (§ 7 and § 8). School closure protections contained in § 4 and § 5 above would be extended to veterans in the VR&E program (known as chapter 31 benefits), which were not covered under current law. In addition, VR&E participants who were satisfactorily participating in employment services from March 1, 2020, through December 21, 2020, may receive an additional 2 months of living allowances.

CARES Act Higher Education Provisions

SEC. 3502. DEFINITIONS.

This section defines key terms used in the higher education provisions in the CARES Act, including coronavirus, institution of higher education, qualifying emergency, foreign institution, and the Secretary to ensure a consistent understanding of their use. For example, a qualifying emergency is a public health emergency related to the coronavirus as declared by either the Secretary of Health and Human Services or the President and “the Secretary” is the U.S. Secretary of Education (ED).

SEC. 3503. CAMPUS-BASED AID WAIVERS.

Institutions participating in the Federal Work Study (FWS) and Federal Supplemental Educational Opportunity Grant (FSEOG) programs are normally required to provide a non-federal share of the financial compensation paid to students under each program.[10] §3503 requires the Secretary of Education to waive the 25 percent institutional share requirement for award years 2019-20 and 2020-21. For-profit schools are excluded from this waiver. In addition, this section also gives institutions the flexibility of transferring up to 100% (rather than 25%) of their unexpended allotments for FWS and FSEOG programs during the coronavirus emergency to a different section of the HEA statute in order to offer an arrangement of types of aid, including institutional and state aid, which best fits the needs of each individual student.[11]

SEC. 3504. USE OF SUPPLEMENTAL EDUCATIONAL OPPORTUNITY GRANTS FOR EMERGENCY AID.

The Federal Supplementary Education Grant program under Title IV of the HEA awards emergency federal grants of between $100 to $4,000 a year to students who demonstrate a financial need. Under this provision, an institution of higher education may reserve any amount of the supplemental grants it receives from ED under this program for emergency financial aid grants for undergraduate or graduate students for unexpected expenses and unmet financial needs during the coronavirus emergency. To determine eligibility for emergency financial aid, the institution of higher learning may (1) waive the amount-of-need calculation; (2) allow a student to receive emergency funds up to the maximum federal Pell Grant for that year; and (3) utilize, under specified conditions, contacts with scholarship-granting organizations to help disburse the funds. Emergency aid under this rule is not treated as other financial assistance as defined in the HEA.

SEC. 3505. FEDERAL WORK-STUDY DURING A QUALIFYING EMERGENCY.

During the coronavirus emergency for a period not exceeding 1 academic year, institutions participating in the FWS program are allowed to continue making payments to students who were unable to complete some or all of their work study obligations due to the emergency.

SEC. 3506. ADJUSTMENT OF SUBSIDIZED LOAN USAGE LIMITS

In general, new borrowers as of July 1, 2013, are ineligible for subsidized federal student loans once the period of time for which they have received such loans equals 150 percent of the published length of the education program in which they are enrolled. [12] Federally subsidized loans made to students shall be excluded from these usage limits should any student fail to complete any semester (or equivalent) due to a qualifying emergency if ED is able to administer the policy in a way to limit the burden and complexity on the student.

SEC. 3507. EXCLUSION FROM FEDERAL PELL GRANT DURATION LIMIT.

Pell Grants have a cumulative lifetime cap of 12 semesters for an undergraduate student attending school full-time.[13] This provision allows ED to exclude any semester in which a student does not complete due to the coronavirus emergency. However, § 3507 includes a caveat: “if the Secretary is able to administer such policy in a manner that limits complexity and the burden to the student.”

SEC. 3508. INSTITUTIONAL REFUNDS AND FEDERAL STUDENT LOAN FLEXIBILITY.

Section § 1091(b) of the HEA requires the return of Title IV funds to ED on a prorated basis for students receiving federal student aid who withdraw from school before completing 60 percent of the term. If students withdraw before completing 60 percent of the term due to the coronavirus emergency, § 3508 requires the Secretary to provide the following waivers:

- Institutional Waivers relate to a school’s responsibility to refund the student’s federal grant or loan to ED. The institution shall report to the Secretary each individual student’s grant or loan assistance amount (other than Federal Work Study grants under part C of HEA) as well as the total amount of grant or loan assistance it has not returned under title IV as part of this waiver.

- Student Waivers relate to a student’s requirement to reimburse ED with respect to Pell Grants or other grant assistance.

In addition, (1) the student’s obligation to repay the entire portion of a loan to ED is cancelled if the recipient withdraws during the payment period as a result of the coronavirus emergency; and (2) a student does not need to return at the same point in the academic program to continue receiving federal student aid if a school grants a leave-of-absence as a result of the coronavirus emergency and the student returns during the same semester.

SEC. 3509. SATISFACTORY ACADEMIC PROGRESS.

Students receiving federal student aid must maintain “satisfactory academic progress” in order to continue receiving such aid. § 3509 allows an institution to exclude from its compliance calculations any courses that were not completed due to the coronavirus emergency without a student’s appeal.

SEC. 3510. CONTINUING EDUCATION AT AFFECTED FOREIGN INSTITUTIONS.

Institutions of higher learning in other countries may be eligible to receive title IV aid for American students attending these programs. Under § 3510, in the case of a public health emergency, major disaster, or national emergency declared by the applicable government in which a foreign institution is located, ED may authorize any part of an otherwise eligible program to be offered via distance education for the duration of the emergency and the following payment period for purpose of Title IV of the HEA. This authority is limited to institutions that offered an otherwise eligible program in part or in whole via distance education between March 1, 2020, and the date of enactment of the CARES Act.

The Secretary may allow foreign institutions to enter written arrangements with institutions of higher education in the U.S. that participate in the Direct Loan program to allow students with such loans to take part in courses from the U.S. institutions for the duration of the qualifying emergency. A foreign public or nonprofit institution may enter into a written agreement only with U.S. schools that meet the HEA’s requirements for institutions of higher education, e.g., public or nonprofit schools accredited by an organization recognized by ED. In addition, private foreign graduate medical, nursing, or veterinary schools may also enter into written agreements with U.S. institutions of higher education as authorized by § 1001 or § 1002 of the HEA. The Secretary is required to submit periodic reports to the authorizing committees identifying each foreign institution carrying out distance education programs and institutions entering written agreements with U.S. institutions.

SEC. 3512. HBCU CAPITAL FINANCING.

The Secretary of Education may grant a deferment to institutions that received a loan under the HBCU Capital Financing Program for the duration of the coronavirus emergency.[14] The Secretary shall make the principal and interest payments during the emergency. At the closing of a deferred loan under this provision, the institution is required to repay the principal and interest amounts made by the Secretary except that no repayment shall begin until one full fiscal year after the end of the coronavirus emergency.

The authority to provide a deferment shall terminate on the date the coronavirus emergency ends, and any provision of a loan/insurance agreement modified by this section shall remain in effect for the duration of the loan. The Secretary is required to submit periodic reports to the authorizing committees identifying institutions receiving assistance under this section. $62,000,000 is appropriated for this program out of money from the Treasury not otherwise appropriated.

SEC. 3513. TEMPORARY RELIEF FOR FEDERAL STUDENT LOAN BORROWERS.

This provision suspends student loan payments for some, but not all federal student loans, through September 30, 2020. The suspension applies to payments for Direct Loans issued by the Department of Education and Federal Family Education Loan Program loans that are held by ED. In addition, § 3513 stipulates that (1) no interest will accrue on Direct Loans; (2) borrowers will still receive credit toward loan forgiveness or rehabilitation programs even though payments are suspended; (3) information provided to consumer reporting agencies will treat suspended payments as payments that were made; (4) all involuntary collections related to defaulted loans, such as wage garnishment, are also suspended; and (5) borrowers will be notified about this temporary loan payment relief within 15 days of enactment of the CARES Act, including their ability to continue making payments toward principal and to enroll in income-driven repayment programs. ED must notify borrowers at least six times (via mail, email, and telephone) that these suspensions are temporary and when their obligations will resume.

Loans issued under the Federal Family Education Loan Program (FFELP) that are not held by ED, federal Perkins Loans, and private student loans were excluded.[15] FFELP loans were issued by private lenders but guaranteed by the federal government and ceased to be offered as of June 30, 2010. According to a report by the Department of Education’s Inspector General, lenders held about $260 billion in FFELP loans as of 2013, about 20 percent of outstanding federal student loans at that time. FFELP loans as a percentage of all federal loans has declined since the Inspector General’s 2013 report because only Direct Loans have been issued since 2010.

SEC. 3514. PROVISIONS RELATED TO THE CORPORATION FOR NATIONAL AND COMMUNITY SERVICE.

The Corporation of National and Community Service (CNCS) is an independent federal agency whose mission is to provide opportunities for Americans to engage in service to address the nation’s pressing unmet needs. As a public-private partnership, the Corporation oversees three national service initiatives: Learn and Serve America, AmeriCorps, and Senior Corps. § 3514 allows individuals whose national service is reduced or interrupted because of the coronavirus emergency to accrue service hours that will count towards the total number of hours needed to earn an “education award.”[16] If individuals were required to leave their service positions early at the direction of CNCS, they may be deemed as having met the service position’s requirements and be awarded the full value of the educational award. All funds made available to CNCS shall remain available through the fiscal year ending September 30, 2021.

In addition, the CNCS may permit fixed-amount grant recipients under 42 U.S.C. § 12581(l) to maintain a pro-rata amount of funds for participants who exited, were suspended, or are serving in a limited capacity due to the coronavirus emergency. CNCS may extend terms of service or waive any upper age limit (up to 26 years of age) for national service programs under 42 U.S.C. 12611 to address disruptions due to the coronavirus emergency and to minimize the difficulty in returning to full operation for such programs and participants.

SEC. 3515. WORKFORCE RESPONSE ACTIVITIES.

The Workforce Innovation Opportunity Act (WIOA) provides funds to states for workforce development programs.[17] This provision increases the cap on allocated funds for administrative purposes to state “local areas” from 10 percent to 20 percent if the increase is used to respond to the coronavirus emergency. Moreover, § 3515 authorizes governors to use any unobligated 2019 program year funds reserved for statewide activities to fund rapid response activities developed as a result of the coronavirus emergency. State governors must release those funds to local boards within 30 days of the enactment of the CARES Act.

SEC. 3516. TECHNICAL AMENDMENTS.

In December 2019, the Congress reauthorized mandatory funding programs for historically black colleges and universities and other minority serving institutions in the FUTURE Act, P.L. 116-91. The FUTURE Act had amended provisions of the Internal Revenue Service (IRS) code related to the confidentiality of income tax returns to allow redisclosure to institutions of higher education, state higher education agencies and designated scholarship organizations solely for use in the application, award, and administration of financial aid. § 3516 makes additional technical amendments to the same IRS code.

SEC. 3517. WAIVER AUTHORITY AND REPORTING REQUIREMENT FOR INSTITUTIONAL AID.

This provision allows ED to waive certain requirements for minority and Hispanic serving institutions and for master’s degree programs at historically black colleges receiving grants though the federal fiscal year following the end of the coronavirus emergency. Requirements that may be waived include: (1) eligibility data requirements, (2) wait-out periods,[18] (3) various allotment requirements,[19] and (4) any statutory or regulatory provisions to help ensure that qualifying institutions are not adversely affected by any formula calculation. Moreover, any funds paid to the institution that were not expended for their intended purposes during the 5 years after they were initially provided may be used for an additional 5 years. The Secretary is required to provide periodic reports to the committees of jurisdiction on the institutions to which waivers were granted.

SEC. 3518. AUTHORIZED USES AND OTHER MODIFICATIONS FOR GRANTS.

The Secretary may modify the required and allowable uses for grants under HEA to an institution of higher education or other grant recipient (not including individuals receiving federal financial aid) at the request of the recipient as a result of the coronavirus emergency.[20] The Secretary can modify any federal share or other financial matching requirement for certain grant awards at the request of the institutions or other grant recipient as a result of the coronavirus emergency.[21] This authority expires on September 30th of the fiscal year following the end of the coronavirus emergency.

Any funds paid to an institution under certain grant programs and not expended or used during the 5-year period following the date they were first paid to the institution may be carried over and expended during the succeeding 5-year period. ED is required to submit periodic reports to the authorizing committees identifying institutions receiving a modification under this section.

SEC. 3519. SERVICE OBLIGATIONS FOR TEACHERS.

The HEA provides “TEACH grants” to undergraduate and graduate students who are preparing for a teaching career for certain high-need subjects in high poverty areas.[22] Grants are converted to federal loans if recipients do not fulfill their teaching service requirements. This provision allows the Secretary to modify the categories of extenuating circumstances under which grantees are unable to fulfill their service obligation requirements and to consider the period of interrupted service as meeting those requirements during the duration of the coronavirus emergency. In addition, the Secretary may waive the requirement that the years of teaching be consecutive in order to qualify for loan forgiveness if the teaching service of a borrower is interrupted due to the coronavirus emergency and the borrower resumes teaching and completes a total of 5 years of qualifying teaching.

SEC. 18004. HIGHER EDUCATION EMERGENCY RELIEF FUND (p. 287)[23]

The CARES Act established an educational stabilization fund to be available through September 30, 2020 and dedicated 46.3 percent ($14.25 billion) to institutions of higher education. § 18004 directs ED to allocate funding to higher education institutions as follows:

- 90 percent to each institution of higher education to prevent, prepare for, and respond to coronavirus, by apportioning it:[24]

- 75 percent distributed to institutions according to full-time equivalent enrollment of federal Pell grant recipients who are not exclusively enrolled in distance education courses prior to the emergency;

- 25 percent distributed to institutions according to the share of full-time-equivalent enrollment of students who are not Pell Grant recipients enrolled exclusively in distance education courses prior to the emergency;

- 5 percent for additional awards to HBCUs and minority serving institutions to defray expenses related to lost revenue, for technology costs associated with moving to online instructions, and for grants to students for any component of the student’s cost of attendance;[25] and

- 5 percent for institutions that ED determines have the greatest unmet needs related to the coronavirus emergency, which may be used to cover expenses and for grants to students for any component of the student’s cost of attendance (under § 472 of the HEA).

Distribution shall be made available to all institutions under the same systems that the Secretary uses to distribute funding under Title IV. At least 50% of the funds provided to the institutions must be used to provide emergency financial aid grants to students for expenses related to the coronavirus emergency. The institutions may use the funds for any costs associated with significant changes to the delivery of instruction due to the coronavirus as long as they do not include payments to contractors for pre-enrollment activities; endowments; or capital outlays for sectarian instruction, religious worship, or athletics. The Secretary shall give at least $500,000 to institutions that are not otherwise eligible under (1) and (2) above if they demonstrate significant unmet needs related expenses to coronavirus. Institutions are required to submit a report to the Secretary when requested to do so.

[1]Many of the HEA provisions cross reference numerous statutory requirements and are challenging to parse. Although we reviewed the statutory language cited in the specific sections of the CARES Act, we also used an October 2018 report on the HEA prepared by the Congressional Research Service to better understand the referenced statutory requirements. The National Association of Student Financial Aid Administrators has also established a useful resource for developments related to the coronavirus emergency and its impact on students in postsecondary education.

[2]See this link for a definition of minority serving institutions.

[3]The CARES Act did not address continued VA work study payments to GI Bill beneficiaries which are authorized by 38 U.S.C 3485. HR 6322, discussed on pg. 4 of this report, would address this.

[5]The remaining 10 percent of funds will be allocated among Historically Black Colleges and Universities, minority-serving institutions, and other institutions that the Education Department determines have the greatest unmet need.

[6]According to our analysis of Department of Education 2015-16 survey data, about 20 percent of undergraduate and 40 percent of graduate students who were using GI Bill benefits were enrolled in exclusively online programs. The majority of GI Bill students, however, are enrolled in undergraduate credential programs.

[7]Bridgepoint was rebranded as Zovio and the Career Education Corporation is now known as Perdoeco.

[8]See VES Issue Brief on § 3696 here for background on this statutory requirement.

[9] See generally, U.S. Senate Committee on Health, Education, Labor and Pensions, “For-Profit Higher Education: The Failure to Safeguard the Federal Investment and Ensure Student Success,” (2012) available at https://www.help.senate.gov/imo/media/for_profit_report/PartI-PartIII-SelectedAppendixes.pdf.

[10]FWS provides part-time employment to undergraduate and graduate students who need earnings to pursue their degrees (see p. 14 of link). In contrast, FSEOG (see p. 11 of link) is needs based grant aid awarded to undergraduate students with exceptional needs. https://ifap.ed.gov/electronic-announcements/12-04-2018-campus-based-subject-information-about-designation-title-iii-or.

[11]https://www.law.cornell.eu/uscode/text/20/1095#fn002097.

[14]This program provides federal insurance for bonds issued to support financing projects at HBCUs. For more information on the program see p. 11 of this link.

[15]On April 3, 2020, the Washington Post reported that several large holders of private student loan debt as well as others it had contacted were halting debt collection lawsuits for at least 2 months. If lawsuits are successful, lenders can garnish borrowers’ wages and seize their assets.

[16]See 42 U.S.C. § 12601 at this link. The education award may be used to pay educational expenses at eligible post-secondary institutions, including many technical schools and G.I. Bill approved programs, or to repay qualified student loans. The dollar amount of the education award is equal to the maximum amount of the U.S. Department of Education Pell Grant and may change year to year.

[17]WIOA, enacted in 2014, replaced the Workforce Improvement Act of 1998. According to the Congressional Research Service, the objective of WIOA is to “bring about increased coordination among federal workforce development and related programs.” Such programs may include activities including job search assistance, career counseling, occupational skill training, or on-the-job training.

[18]Each eligible institution that received a grant under this part for a 5-year period shall not be eligible to receive an additional grant under this part until 2 years after the date on which the 5-year grant period terminates.

[19]The allotment requirements are described in 20 U.S.C. 1059(e).

[20]Applies to the following grant programs: 20 U.S.C. 1057 (to improve the academic quality, institutional management, and fiscal stability of an institution); 1060 (grants to historically black colleges and universities); 1070a-11 (grants to organizations with experience serving disadvantaged youth); 1070-21 (early intervention and college awareness program); 1101 (Hispanic serving institutions); 1136a (master’s degree programs at historically black colleges).

[21]Applies to the following grant programs: 20 U.S.C, 1057, 1060, 1136a.

[23]The Higher Education Emergency Relief fund is a subset of an Education Stabilization Fund totaling $30.75 billion. The stabilization fund reserves (1) 9.8 percent for governors who submit an application to provide emergency support to both secondary and postsecondary institutions that they determine have been the most significantly affected by the coronavirus emergency; (2) 43.9 percent for elementary and secondary schools; and (3) 46.3 percent for institutions of higher education.

[24]In addition, § 18007 provided $7 million to Gallaudet University to respond to the coronavirus emergency with those funds to remain available until September 30, 2021.

[25]In addition, § 18007 provided $13 million to Howard University to respond to the coronavirus emergency with those funds to remain available until September 30, 2021.

Final Coronavirus IHE provisions 4_17_2020.v2